There are certain images we have of tech companies, and of the business they’re in. But there are often surprises when you look at their bottom line — products that may seem like a minor sideline actually contribute significantly to their profits. These lesser-known products and divisions can significantly impact the performance of tech stocks.

One example is Logitech (NASDAQ:LOGI). People know the company as a manufacturer of personal computer accessories, such as mice and keyboards. But those accessories aren’t the only thing driving the company’s growth — up 170% since 2016.

Logitech also owns brands popular with music-loving consumers, a “sideline” that’s helped it take advantage of the rise in streaming music. This “sideline” includes one of the most popular portable Bluetooth speaker brands: Ultimate Ears. And in 2016, Logitech bought leading wireless earbud brand Jaybird.

In 2019, portable speakers, earbuds and audio gear brought in more than $500 million, over 18% of LOGI’s total annual revenue.

Here are three other tech stocks that make money in a surprising way.

Tech Stocks: Amazon (AMZN)

Ask the average person how Amazon (NASDAQ:AMZN) makes money and the answer will likely be online retail sales. They may look around their living room and add Alexa-powered Echo smart speakers to the mix.

There’s no argument that Amazon.com generates a ton of revenue. Online sales for the e-commerce giant hit $141.3 billion in 2019. And in a smart speaker category that’s been rapidly growing for several years, Amazon’s Echo still holds a commanding 70% lead in U.S. homes.

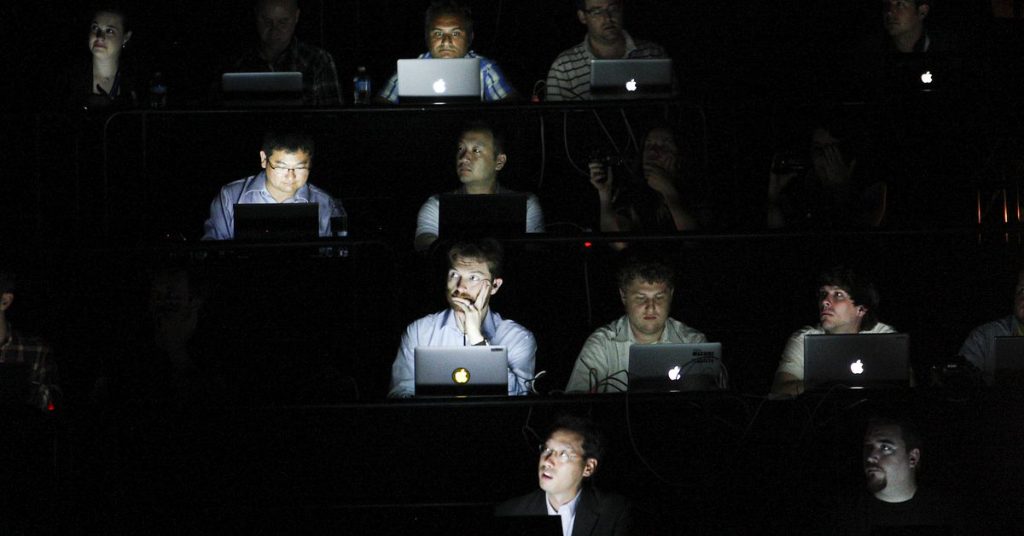

But it’s a behind-the-scenes division that actually accounts for the lion’s share of Amazon profits. Amazon Web Services (AWS) is a cloud computing enterprise that provides the processing and hosting capabilities that make Amazon.com and Alexa hum. It powers some of the world’s most popular apps, websites and services, including Netflix (NASDAQ:NFLX).

AWS has also become a primary driver of Amazon stock, generating over 70% of the company’s total profits.

HP (HPQ)

Source: Ken Wolter / Shutterstock.com

HP (NYSE:HPQ) was created in 2015 when Hewlett Packard split into two companies. HP focuses primarily on computer and printer sales. In 2019, it was the world’s second-largest PC vendor, with 23.9% of the global market.

However, the big profit driver for HP isn’t computers. It’s not printers, which are often sold at cost or even a loss. It’s high-margin printer ink.

Computers may bring in the revenue, but printing (and primarily replacement ink cartridges) have been accounting for 80% of HPQ’s profits.

With that profit stream under pressure, HP has been fighting to block the use of third-party replacement cartridges. It’s also reportedly considering increasing the price of the printers themselves.

Apple (AAPL)

Everyone knows the iPhone is Apple’s (NASDAQ:AAPL) big revenue and profit machine, even if it has been running out of steam lately. Slumping smartphone sales have been a concern for many tech stocks in recent years.

Apple has other product lines to boost revenue, including the Apple Watch, and services like Apple Music.

What you may not realize is how big a business AirPods have become for the company. The white wireless earbuds with the weird stem have become an incredibly popular accessory. With multiple generations including the latest AirPods Pro on the market, Apple is projected to sell 85 million pairs in 2020. That’s about $15 billion in revenue.

One analyst did the math and calculated that if AAPL spun off AirPods into their own business, the resulting company could have a $175 billion valuation. It would be one of America’s top-value companies, claiming a spot around No. 30.

That’s not bad for a “sideline” that was mocked on release.

Brad Moon has been writing for InvestorPlace.com since 2012. He also writes about stocks for Kiplinger and has been a senior contributor focusing on consumer technology for Forbes since 2015. As of this writing, Brad Moon did not hold a position in any of the aforementioned securities.

— Investorplace.com to investorplace.com